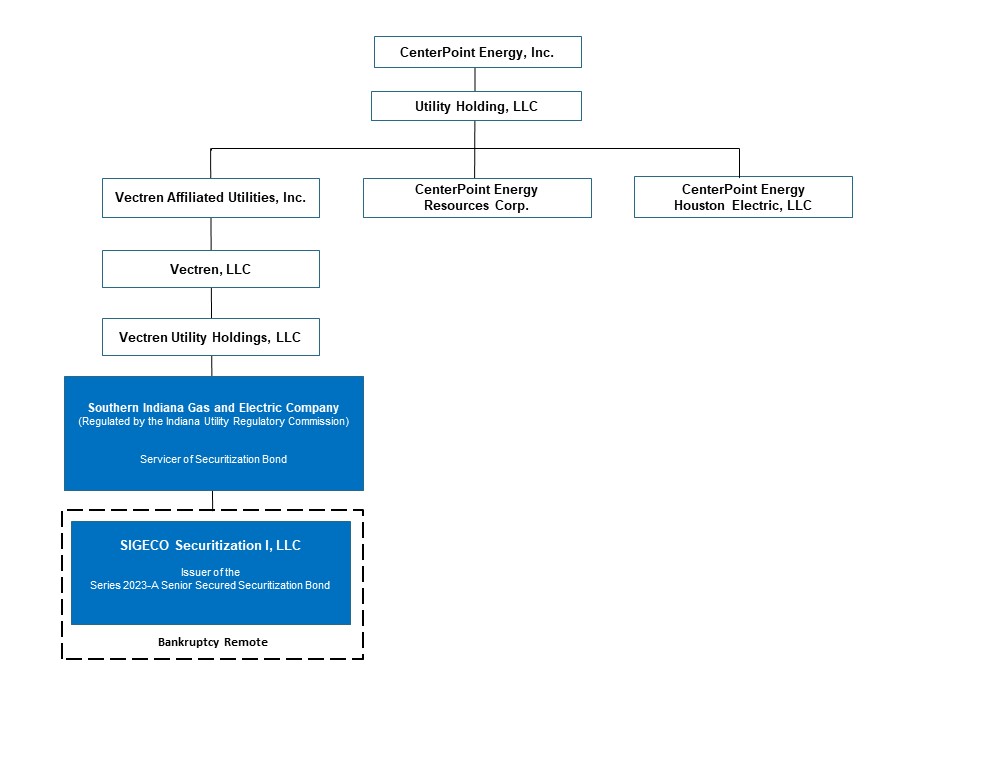

Securitization Bond Company

The Securitization Act was enacted in 2021 by the Indiana General Assembly to allow certain electric utilities to use securitization financing (through the issuance of securitization bonds secured by securitization property) to recover qualified costs associated with the retirement of certain qualifying electric generation facilities by collecting securitization charges from retail customers of the electric utility. SIGECO Securitization I, LLC, a wholly owned subsidiary of Southern Indiana Gas and Electric Company (“SIGECO”), issued $341,450,000 initial principal amount of securitization bonds in June 2023.

Qualified costs include the net original cost of the facility and any associated investments, and, as adjusted for depreciation, costs for removal or restoration, any investment tax credits for the facility, costs of issuing, supporting and servicing securitization bonds, taxes for recovery of securitization charges, and any costs of retiring and refunding existing debt securities related to the securitization bonds.

Under the Securitization Act and the financing order, SIGECO’s retail electric customers will pay securitization charges, which are non-bypassable charges included in their monthly bills. SIGECO, as the servicer, bills and collects the securitization charges from its electric customers. These securitization charges will fund payments of principal and interest on the securitization bonds and other financing costs. Unless the context implies otherwise, references to the “financing order” are to the financing order issued by the Indiana Utility Regulatory Commission (the “IURC”) in SIGECO’s Cause No. 45722 on January 4, 2023, as supplemented by the order issued by the IURC on May 3, 2023.